search

date/time

| Yorkshire Times A Voice of the Free Press |

12:00 AM 18th September 2025

frontpage

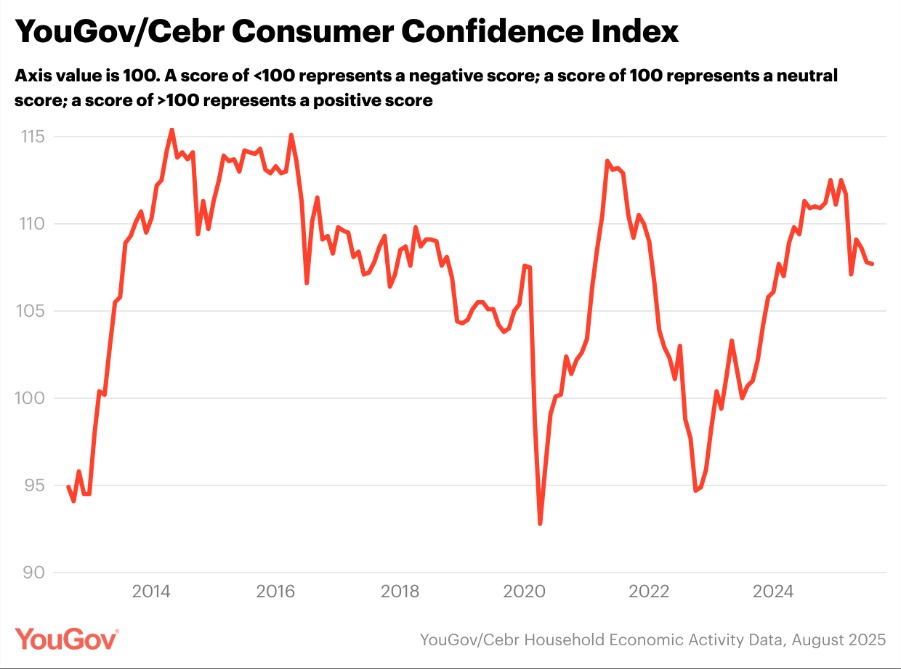

YouGov: Consumer Confidence Stagnated In August

Overall YouGov/Cebr consumer confidence index moved by -0.1 points

Confidence in house prices fell retrospectively (-1.5) and looking forward (-2.3)

Perceptions of household finances over the past 30 days saw little movement (+0.1), but improved for the forward-looking measure (+1.8)

Retrospective business activity measures fell (-0.7), but outlook improved (+1.9)

Workers were more upbeat about their job security over the past 30 days (+0.6) but more downbeat about the future (-1.5)

Consumer confidence saw little change in August 2025, according to the latest data from YouGov and the Centre for Economics and Business Research (Cebr). The overall index fell by -0.1 points from 107.8 to 107.7, with the underlying measures reflecting a mixture of positive and negative changes month-on-month.

As for household finances, our data shows that short-term scores saw very slight movement from 88.0 to 88.1 (+0.1), but consumers were more optimistic about the next 12 months. Our forward-looking metric showed an uptick from 90.6 to 92.4 (+1.8) in August after declining by -2.6 points in July.

Other metrics were more of a mixed bag. Among workers, job security saw an increase from 91.7 to 92.3 (+0.6), but outlook deteriorated by the same amount – slumping from 116.4 to 115.7 (-0.6). Meanwhile, business activity decreased from 108.3 to 107.6 (-0.7) for the retrospective measure, but outlook improved from 118.6 to 120.5 (+1.9).

Commenting on the results, Cebr’s Head of Forecasting and Thought Leadership, Sam Miley, said: “The YouGov/Cebr Consumer Confidence Index has now fallen for three consecutive months, for the first time since the period surrounding the ill-fated mini-budget in 2022. Delving deeper into the metrics, there is continued weakness in households’ perceptions of near-term job security and of their household finances, despite slight improvement from last month. This highlights the impact of the weakening labour market and elevated inflation on consumers.”

.png)